The insurance industry is associated with a fast work pace and a large number of daily applications. For insurance specialists, there is a limit on how much work they can handle quickly and effectively, so insurance companies risk losing clients. The best solution is to build an insurance agency software and automate most of the routine processes.

Read our article to learn why efficient management software for insurance agents is a must for the modern insurance business and how to create a solution.

In IT since 1993, SaM Solutions offers professional custom software development services to clients across all industries.

Why Develop Insurance Management Software?

The year 2017 ended with worldwide CRM (customer relationship management) systems revenue amounting to $39.5 billion, which made CRM the largest software market, overtaking that of database management systems, according to Gartner. In 2018, the segment continued to lead as the fastest growing software.

Research by Statista shows an impressive increase in global CRM revenue from 2010 to 2017.

Customer relationship management (CRM) software revenue worldwide from 2010 to 2017 (in billion U.S. dollars)

Source: Statista

Why is this technology such a profitable investment? There are several reasons. An insurance agency management system software automates multiple processes and makes the work of agents, brokers and the company simple, convenient and transparent at all stages.

Insurance automation enables keeping records in a single database and providing services on a single platform. As a result, insurance agents are exempted from using numerous accounting programs. Instead, they get one flexible and easy-to-use product that allows effective management of the client base and documents without a professional technical background.

Another benefit of insurance management software is its high capacity. The system is able to handle several thousand users working simultaneously and provide online support to both employees in the head office and in the remote branches. Such availability is possible due to cloud-based CRM solutions.

An important feature of the insurance business is the low frequency of client requests (once a year, as a rule). This means that an insurance company should store personal data over a long period of time. When using many separate programs, some information can be easily lost, and a client will have to provide it again with the next request, which irritates the customer and is not time-efficient.

Unified CRM platforms can store large amounts of customer information, minimizing costs and improving the quality of services. The cloud also provides high-grade security of personal data.

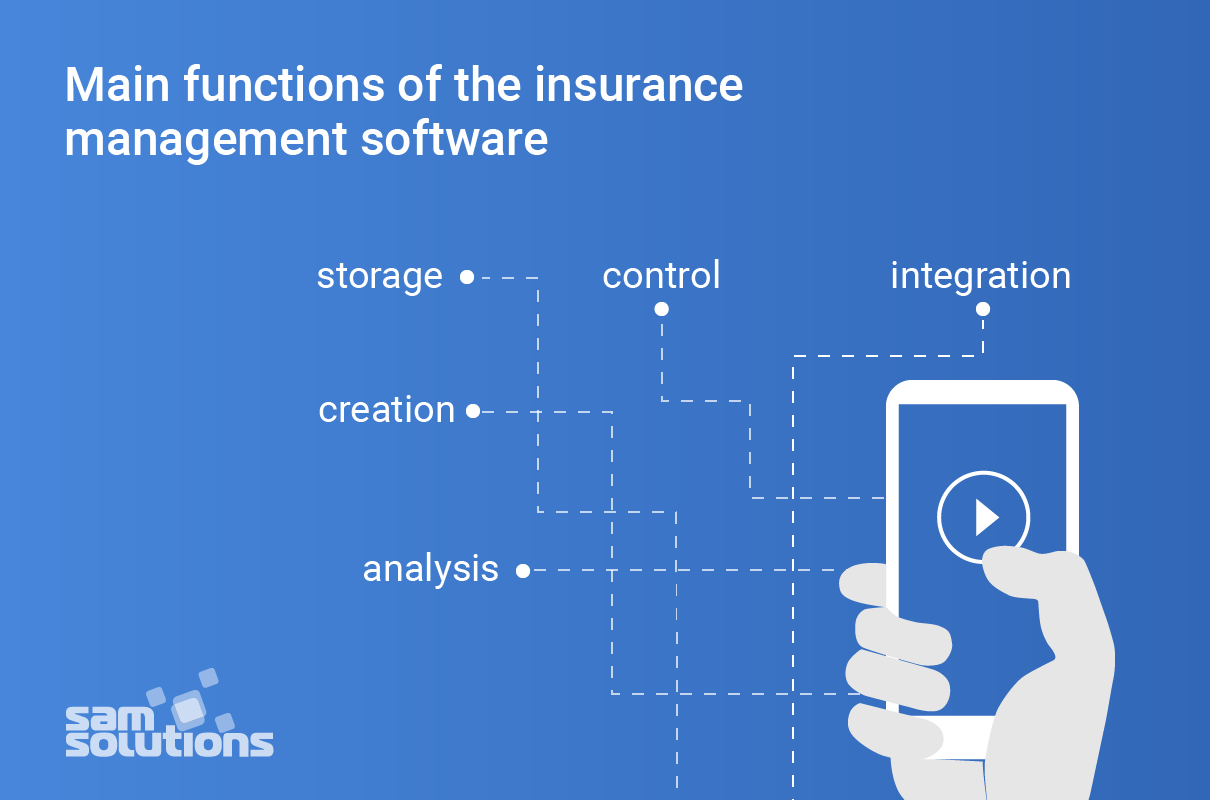

The Main Features of Insurance Software Solutions

Specialized management software meant for all-around automation of insurance agencies should include a wide range of functions to reduce the burden on managers and increase efficiency.

Storage

Software for insurance agency performs an important function of storing and protecting large amounts of data. The system keeps client records such as names, phone numbers, addresses, as well as information concerning current and completed contracts, transactions, etc.

Integration

An agency management system for insurance operations can be integrated with other solutions to perform various routine tasks. For instance, you can integrate the IP telephony to call customers directly from the CRM system or integrate analytics tools to build reports and dashboards.

Creation

Insurance agency software solutions are equipped with numerous templates to quickly create necessary documents. There may be templates for insurance applications, contracts, invoices and more. The system can also generate automated emails, text messages and notifications to keep clients informed.

Control

Numerous daily operations within an insurance agency are of high importance and require accurate monitoring. Agency management systems for insurance are able to provide continuous control of transactions, payments, debts and accountable forms and alert responsible persons in case there are some deviations. Management software allows controlling and estimating activities of employees to calculate bonuses for the work done.

Analysis

If you want to reveal the pros and cons of your agency’s performance and improve efficiency, you should analyze all data flows and draw conclusions. Analytics tools incorporated into insurance agency management systems allow searching, grouping, sorting of data upon various criteria and then, creating reports.

Out-of-the-Box vs. Custom Insurance Solutions

Establishing and managing a solid relationship with clients is the core task of any business. These days, the majority of successful companies automate workflows and create a seamless customer experience relying on online cloud-based CRM systems. There are two options for how you can get such a system: use ready-made solutions or make software for insurance agents from scratch.

Out-of-the-Box Software

Numerous vendors offer solutions for large enterprises (SAP, Salesforce, Microsoft, Oracle) and for small and medium businesses (Zoho, Nimble). Some systems are free and open-source, others require license fees. In any case, such solutions have obvious benefits: they are easy to install and use; have many built-in features; are able to adapt to different needs.

There are industry-specific CRMs that include specialized features tailored to certain needs such as:

- Financial services CRM (e.g BNTouch)

- Real estate CRM (e.g. Wise Agent)

- Management agency software for health insurance (e.g. AgencyBloc)

- Field service management systems (e.g. Microsoft Dynamics 365)

Two major problems with out-of-the-box software are the high costs (in the case of free software, maintenance and support can still be chargeable) and many excessive features that your organization may never use.

Custom Software

If you need an app that is perfectly suited to your requirements, you should build it from scratch. In this case, you will get a unique program tailored to your needs at a lower price.

Benefits of custom development

- Individual configuration — since the system is tailored to your exact needs it is lightweight, meaning that there are no extraneous features developed; this results in better integration with all your business operating systems.

- Easy modification and scalability — you can keep in step with your business changes modifying and expanding whatever you need in your CRM system; it is possible because you are the software owner.

- Competitive advantage — off-the-shelf solutions provide the same toolset for various companies; but when you create a well-designed custom solution, you can have tools that your competitors don’t have, consequently, you can get well ahead.

- Better security — a custom-made solution is able to better protect private data as it has only one owner, while out-of-the-box software can be purchased by anyone, which greatly threatens cybersecurity.

Above all, it quite often takes less time to build a new small system than to customize a large one.

Salesforce, as well as most vendors, offers a platform for custom CRM app development. You can create apps for IT, marketing, HR, finance departments and more.

How Do You Build Insurance Agency Management Software?

Now, let’s see how to create software for an insurance company from scratch, step by step.

Define Goals

The first thing you should do is define the main goals and objectives of your future CRM. They can vary, depending on the specifics of the company. The most common goals are:

- Tracking leads and their activity

- Maintenance of the customer base

- Optimization of work with clients

- Organization of business operations

- Optimization of cooperation between departments

- Increase in labor productivity

A careful analysis of goals and objectives, as well as their prioritization, will help design a CRM system with the optimal set of functions.

Decide on Structure

Think about the building blocks the system will consist of. The essential components for an insurance system may include:

- Accounts (information about companies you work with)

- Contacts (contact information of people you work with)

- Leads (potential clients)

- Opportunities (qualified leads)

- Activities (tasks, meetings, phone calls, emails)

Create a Database

Choose a database management system, for example, MySQL, build a diagram that includes the necessary entities and the logical links between them. Once you are satisfied with the DB structure, create a database, using relevant tools.

Create a Page Template

It’s a good practice to make a reusable page template containing a header, body and a footer. You can use HTML, PHP or any other language. When the template is ready, use it to create as many pages as you need, filling them with relevant content.

Remember that management software must meet security standards to be a reliable storage place of confidential personal and commercial information.

Modern Trends in the Development of CRM Applications

A CRM application should have an intuitive interface and be flexible to quickly configure to specific customer requirements. Among other trends for insurance app development are:

- Mobility — a mobile app is a useful supplement for CRM because both customers and employees prefer having access to the system wherever they are.

- Cloud technologies — cloud computing provides the most secure way of data storage and exchange.

- Social media — content-based marketing is now a global trend, so the demand for SMM analytics tools within CRM is absolutely justified.

Best Insurance Agency Management Systems

Today, insurance agency management products are in abundance on the market. The following are some popular real-case examples.

Bitrix24

This is a free full-featured customizable CRM for the insurance industry. Among the main features are unlimited records, email marketing, integrations, custom forms, a mobile app for iOS and Android, etc.

FreeAgent Insurance CRM

This is a sales, marketing and customer service platform that helps agencies achieve and maintain quality customer relationships. You can store records, policies, commissions, phone calls and other important documents in a secure cloud-based space and access them from anywhere.

Insly

This is a simple software aiming to support insurance agents and brokers. The system is cloud-based, and it features all the aspects that one would expect from a broker software including policy issuing, billing, administration, CRM, reporting and multiple quoting functionalities.

Management Software for Insurance Agencies by SaM Solutions

If you are new to programming but need to develop custom software for the insurance business, hire specialists to fulfill this task.

SaM Solutions realizes that the players of the insurance market require efficient software that accurately handles data and enables smart decision-making. For more than two decades, we have been providing consulting, custom software development and maintenance for the insurance industry to help companies thoroughly process big amounts of data, ensure their security and facilitate wise contracting.

Application migration for an insurance agency

Within the scope of one project, SaM Solutions’ talented developers were challenged to migrate more than one million lines of code for eight software applications used in various areas of the insurance industry (social insurance, insurance against accidents, etc.). Our specialists provided a smooth and fastest possible migration of the applications source code from Visual Basic 6.0 to C#, on the basis of General and Product Specific Migration rules, created in collaboration with the client.

The porting of an insurance sales support system

Another project concerned the porting of a system for insurance sales support. The system business logic was ported to a Delphi 7 application with a three-tier architecture. Our specialists also ensured effective data migration from legacy ISAM database to MS SQL.

SaM Solutions specialists also successfully developed a new website for an insurance company, using .NET, Sitecore, AJAX technologies, Microsoft TFS tool and Scrum methodology.

Let’s Create It Together

As you can see, customer relationship management software is a great benefit for any company aiming for success. Whether it is better to use a ready-made solution or to develop a custom program from the ground up, is entirely up to your specific organization and its business requirements.

You are welcome to fill our contact form and ask any questions concerning software development and support. SaM Solutions is here to help you realize your ideas.

The Latest 15 Information Technology Trends in 2024

The Latest 15 Information Technology Trends in 2024 Top 10 Embedded Software Development Tools

Top 10 Embedded Software Development Tools IaaS vs. PaaS vs. SaaS: What’s the Difference?

IaaS vs. PaaS vs. SaaS: What’s the Difference? IoT Development: Top 15 Internet of Things Tools and Platforms in 2024

IoT Development: Top 15 Internet of Things Tools and Platforms in 2024 10 Examples of Predictive Analytics

10 Examples of Predictive Analytics

What Is Headless CMS?

What Is Headless CMS? SAP Commerce Cloud vs Shopify: A Detailed Comparison for Businesses

SAP Commerce Cloud vs Shopify: A Detailed Comparison for Businesses Java and Cloud Development: An Ideal Pairing

Java and Cloud Development: An Ideal Pairing Component-Based Architecture in Software Engineering: A Comprehensive Guide

Component-Based Architecture in Software Engineering: A Comprehensive Guide Micro Frontend: What It Is and How It Works

Micro Frontend: What It Is and How It Works

When you use an insurance management system, you get all the information in a single place, which means better visibility of all processes and improved efficiency of your work.

We’ve implemented a management system in our agency two years ago, and I haven’t had any complaints. The system centralized all agency’s activities and built a client database that can now be easily maintained.

Your experience in developing software solutions for insurance companies is impressive. If I needed such a solution, I would like to partner with your company.

All types of insurance companies can benefit from implementing management software in their processes. This overview is useful for those insurance business owners who need to develop management software but don’t know where to start.

Thanks for covering an interesting topic. The work of insurance agents is associated with tons of customers’ data, and a reliable management software system helps cope with it.

Very interesting to read your blog! A CRM solution is required to build healthy relationships with the customers which in turn help your business to grow. Thanks for sharing it. Keep posting.

Nice and helpful information shared by this post with us about Insurance Agency Management Software and I hope that we will also get more new information regarding this post as soon as. This information is valuable for most of the users.